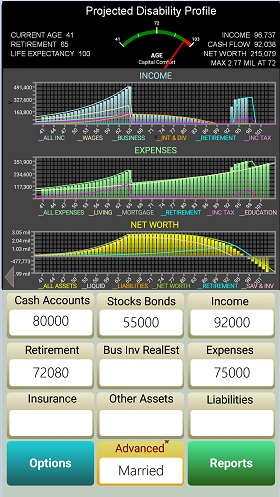

Main screen where you enter applicable data. Each category has items in pull-down menus that are displayed as you tap on a category. In addition. Advanced tab provides you with additional data categories.

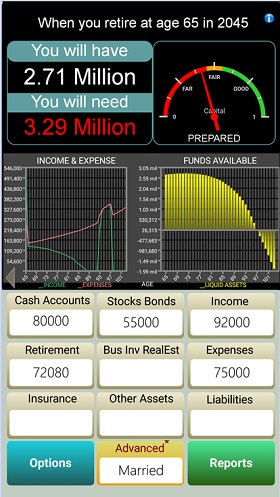

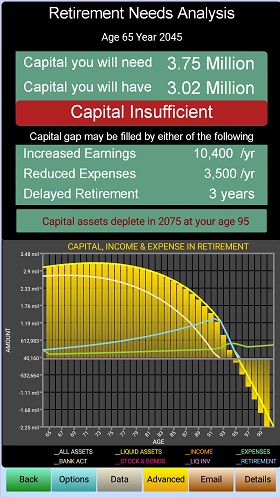

Results can be seen in numbers or as charts and graphs for the entire planning span. All charts and graphs are dynamic in reflecting data values you enter or change as you make your entries.

PlanMode is completely dynamic. All results shown in reports, graphs and charts are bottom line values after all computations. You can choose any format you like for interactive planning.

All development and support for PlanMode, TaxMode (www.taxmode.net) and desktop comprehensive financial planning application systems ExecPlan (www.execplan.com) and ExecPlan Express (www.execplanexpress.com) are based in USA.

Copyright (c) 1977-2021, Sawhney Systems, Inc. All Rights Reserved