Data Entry

INPUT DATA ITEMS

You can enter data in two different ways depending on your input item. If the value of the item is to shown annually across the planning span it is considered recurring. Otherwise, if the value of an item is applicable only in specific years, it should be input as a non-recurring item.

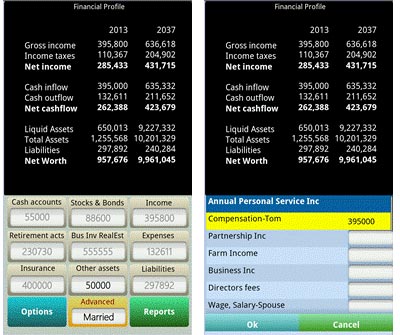

You can either scroll down to each section of search the above category terms to reach there directly. This data can be entered input as single values for the main input categories (Quick input mode) or each category can be expanded to a grid allowing you to input multiple items applied to each input category.  Input Value Future Projections The amount you input for an item is considered its first year value. The value in second and succeeding years is computed based on default growth values entered for this input category. Each year's projected value is uniformly computed by applying the growth rate to the prior year value resulting in normal compounding. Expression Input for Projected Values If the value of an item does not conform to the uniform projection described above the value(s) can either be entered in the Expanded Data Input section or using the Expression Input option available in the main input section. Expression Input allows you to project future values as specifically as needed. For example, an Expression Input entered for wages or salary as- =75000,%10,%9,%8 will compute wages as 75,000 in the first year, growing it by 10% in 2nd year, growing another 9% in the 3rd year and 8% in the 4th and subsequent years. Similarly an expression entered for education expenses as- =0,0,0,40000,45000,50000,55000,0 will imply an education expense of 40,000 in the 4th year, 45,000 in the 5th year, 50,000 in the 6th and 55,000 in the 7th year. Personalization A long click on the default title in the main input menu lets you personalize it. The Quick mode is a quick way to get an almost instant financial profile with just a few key items. Single values can be entered for the following categories:

Following defaults define the treatment of values entered: Cash accounts: Sum total representing total value of cash on hand and all bank accounts with cash equivalent assets.

Default Treatment :Checking account Reports:This value is shown on Balance Sheet and Cashflow Statement Retirement acts; Enter the asset value of all retirement accounts in the current year if using the Quick input mode. Default treatment: IRA Characteristics: Considered as liquid asset Reports: This value is shown on Balance Sheet and Retirement analysis Insurance: A value entered here in the Quick mode or directly in the input box is treated as the face value of life insurance on the life of the first spouse. Default treatment: Life insurance face value on first spouse Characteristics: Life insurance proceeds when first spouse death is assumed Reports: This value is shown on Cashflow Statement when performing survivor’s basic needs analysis Stocks & BondS: This value is used as the total amount of stocks & bonds in the first year. Annual growth can be entered under Options, Settings, Future Growth Default treatment: Mutual Funds Characteristics: Liquid asset reflecting value of stocks & bonds portfolio. This asset is available for liquidation if needed during retirement and for survivor’s needs Reports: It is shown on Balance Sheet Bus Inv RealEst: (Business Investments and Real Estate) – When using Quick input mode a sum total of the values of .business, investments and real estate should be entered here. Default treatment: Sole Proprietor Characteristics: Non-liquid asset. This asset is not made available to Cash Management while analyzing options for funding needs. Reports: It is shown on Balance Sheet Other Assets: This input can be used to reflect an approximate total value of personal assets. Default treatment: Personal Assets Characteristics: Non-liquid asset. This asset is not made available for liquidation to fulfill funding needs. Reports: Balance Sheet item under Non-liquid Assets Income: This input should reflect sum of all income in the current year when entering data using the Quick mode. Default treatment: Wages of the first spouse Characteristics: Source of cash taxable income Reports: Income Statements, Cashflow Statements and part of Adjusted Gross Income in the Supporting SChedule Expenses: All cash expenditure except income taxes can be lumped in this input if using the Quick input mode. Default treatment: Other Expenses Characteristics: Annual cash outflow item Reports: Cashflow Statement as Uses of Cash Liabilities: This input can be used to reflect an approximate value of financial liabilities. Default treatment: Personal Debt Characteristics: This value is subtracted from assets to calculate the net worth each year. Reports: Balance Sheet The following items are available in the Full or Flex data entry modes. Each item is described for its characteristics and where they are shown in the profile. The details include

The following details are listed in order of their category tabs from top left of the main input screen to the bottom right-  Cash On Hand: An approximate average of idle cash available in the first year of the plan. Main input tab:Cash accounts Reports shown in: Balance Sheet and Cashflow Statement Characteristics: This amount is the starting point of annual Cashflow compilation. All cash generated from income, sale of assets and other cash generating items in the first year is added to this value for computing total cash available. Cash outflow is subtracted from the amount of cash available to compute the cash on hand at the end of first year. This amount in turn becomes the Cash On Hand at the beginning of second year, and so until the last year of the planning horizon. The Cash Management feature of PlanMode uses the future values of idle cash to simulate your planning strategy. The Idle Cash Limit can be entered by tapping ADVANCED, MORE, CASH MANAGEMENT, IDLE CASH LIMIT Checking Accounts: Amount at the beginning of the first year of the plan. Other Bank Accounts 1-5:Amount of each bank account at the beginning of the first year of the plan.

IRA.:Individual Retirement Account. Account value of IRA at the beginning of the first year of the plan.

% Wages Contrib:Percentage of wages contributed. Annual amount of contributions made by the respective spouse to this account. This constant percentage is applied to annual wages each year until the retirement age. Employer Match %. This is the percentage of the respective spouse’s wages that are matched for contribution by the employer. Qual Ret Plan Val. Qualified Retirement Plan Value. Account value of self-employed or own business retirement plan at the beginning of the first year of the plan. Taxability of the distribution is based on your input for Tax-free Ret Fund Withdraw item under the Retirement Info tab. If no entry is made the entire amount of distribution is considered taxable It is considered a liquid asset that is available for withdrawal in case of funds needed during retirement or in disability or survivor scenario. The Cash Management feature, when activated, taps qualified retirement plan accounts for liquidation as a source of funds when needed. Annual Contrib: Annual Contribution. Annual amount of contributions made by the respective spouse to this account as a percentage of Business Income. This constant percentage is applied to the respective spouse’s business income each year until the retirement age. Qual Max amount: Qualified Maximum Amount. This is the amount ceiling applied to annual contribution. If the percentage of wages entered above exceeds this amount it is reduced to this limit. Pension Amount: Amount of pension received in the year after the respective spouse retires. Annual % Increase: Growth factor applied to the respective spouse’s pension annually. Soc Sec Income: Social Security Income. Pre calculated amount the respective spouse is expected to receive as Social Security income in the year after retirement starts. Annual % Increase:Growth factor applied to the respective spouse’s Social Security income annually. Age SS Inc Starts:Age when the Social Security income starts for the respective spouse..

Life Ins Benefit: Life Insurance Benefit. This input is for the face value of a life insurance policy on the life of the designated spouse. The input should show the net amount that will be paid out by this policy. Ins Cash Value: Life Insurance Cash Value. This input represents current cash surrender value of the life insurance policy. Life Ins Prem. Life Insurance Premium. Annual policy premiums are represented in this input. Dis Ins Pmt. Disability Insurance Payment. Annual amount paid by the disability insurance policy upon subscriber’s disability. Dis Ins Prem. Disability Insurance Premium. Annual premium paid for the disability insurance policy. SSDI Payment. Social Security Disability Insurance Payment. Annual amount paid by the Social Security in case of disability.

Mutual Funds. Value of a mutual fund account at the beginning of the first year of this plan. Treasury Bills. Value of US Treasury Bills. US Govt Bonds. Value of US Government Bonds. Municipal Bonds. Value of the Municipal Bond account. Corporate Bonds. Value of Corporate Bonds. Stocks/Funds 1-10 (no dividends). These input items can be used to list individual securities or funds that do not pay dividends. Enter the total value of each item. You can change the title of each entry for customized portfolio listing. Stocks/Funds 1-5 (with dividends). These input items can be used to list individual securities or funds that grow in value and generate dividends. Enter the total value of each item. You can change the title of each entry for customized portfolio listing. Bond/Funds 1-5 (Tax-free). These are the Municipal and similar Bonds that generate tax-free interest. input items can be used to list individual bonds or funds that grow in value and generate dividends. Enter the total value of each item. You can change the title of each entry for customized portfolio listing.

Sole Proprietor. Enter its asset value. Partnership. Enter its asset value. Passive Business. Enter its asset value. Farm & Ranch. Enter its asset value. Land. Enter its near-cash asset value. Real Estate 1-2 (near-cash). Enter the near-cash asset value of each investment real estate. Investmnents 1-3 (near-cash). Enter the near-cash asset value of each investment. Real Estate 1-2 (non-cash). Enter the asset value of each investment real estate. Investmnents 1-3 (non-cash). Enter the non-cash asset value of each investment.

Primary Home. Enter current asset value. Vacation Home. Same as Primary Home above. Townhouse. Same as Primary Home above. Automobiles. Personal asset. Enter current asset value. Other Vehicles. Personal asset – same as above. Boat & Yachts. Personal asset – same as above. Airplane. Personal asset – same as above. Gems & Jewelry. Personal asset – same as above. Art & Antiques. Personal asset – same as above. Gold & Coins. Personal asset – same as above. Electronics. Personal asset – same as above. Furniture & Fixture. Personal asset – same as above. Silverware. Personal asset – same as above. Hobby Items. Personal asset – same as above. Other household. Personal asset – same as above. Notes Receivables. Personal asset – same as above. Personal Assets. Personal asset – same as above.

Wages, Salary. Income of the respective spouse from their primary employment in the first year of plan. Partnership Income. Income of the respective spouse from active partnership in the first year of plan. Farm Income. Income of the respective spouse from farming or ranching business in the first year of plan. Business Income. Income of the respective spouse from sole proprietorship in the first year of plan. Directors Fees. Income received by the respective spouse from corporate directorships in the first year of plan. Cash Taxable Int. Cash Taxable Interest Income. Sum total of taxable interest that is cashed out of an account in the first year. Cash Tax exempt Int. Tax Exempt Cash Interest Income. Sum total of interest that is cashed out of an account in the first year and is exempt from income taxes. Cash Dividends. Sum total of dividends that is cashed out of an account in the first year. Rental Income. Sum of net rental income produced by all real estate investments in the first year. Royalty Income. Sum of net royalty income in the first year. Farming Income - Passive. Income from investment in farming or ranching in which neither spouse is actively involved. Alimony Received. Amount received in the first year. Other Taxable Income. Sum of all other taxable income in the first year. Other Non-taxable Income. Sum of all other non-taxable income in the first year.

Mortgage Pmt. Mortgage Payments. Sum of mortgage payments made in the first year. Rent. Sum of rent payments made in the first year. Education. Sum of education related expenses in the first year. Use this input only if education expenses will be incurred in each year of the planning horizon. See note below. Medical Expense. Enter approximate annual amount. Food/Groceries. Enter an approximate annual amount. Clothing. Enter an approximate annual amount. Treated similar to the above. Transportation. Enter an approximate annual amount. Treated similar to the above. Entertainment. Enter an approximate annual amount. Treated similar to the above. Vacations. Enter an approximate annual amount. Treated similar to the above. Gasoline/Tolls. Enter an approximate annual amount. Treated similar to the above. Utilities/Phone. Enter an approximate annual amount. Treated similar to the above. Repair/Maintenance. Enter an approximate annual amount. Treated similar to the above. Other Household. Enter an approximate annual amount. Treated similar to the above. Pocket Expenses. Enter an approximate annual amount. Treated similar to the above. Cash Donations. Enter approximate annual amount. Health Ins Prem. Health Insurance Premium. Enter an approximate annual amount. Treated similar to the above. Auto Ins Prem. Auto Insurance Premium. Enter an approximate annual amount. Treated similar to the above. Other Ins Prem. Other Insurance Premium. Enter an approximate annual amount. Treated similar to the above. Real Estate Taxes. Enter the annual amount. State Income Taxes. Enter the annual amount. City Income Taxes. Enter the annual amount. Other Taxes Paid. Enter an approximate annual amount. Treated similar to the above. Alimony Paid. Enter the annual amount. Business Expense. Enter the annual amount. Subscription Fees. Enter an approximate annual amount. Treated similar to the above. Accountant Fees. Enter an approximate annual amount. Treated similar to the above. Legal Fees. Enter an approximate annual amount. Treated similar to the above. Other Expenses. Enter an approximate annual amount. Treated similar to the above. Final Expenses. Enter an approximated total amount. Estate admin & Legal Expenses. Enter an approximated total amount.

Mortgage. Value of outstanding balance. Auto Loan. Enter an approximate amount of the outstanding balance. Future values are based on the general rate of growth or decline entered in Projection Defaults for liabilities. Student Loan. Enter an approximate amount of the outstanding balance. Same as above. Other Loans. Enter an approximate sum of the outstanding balance for all other loans. Future values are based on the general rate of growth or decline entered in Projection Defaults for liabilities. Credit Card Debt. Enter an approximate amount of the outstanding balance. Future values are based on the general rate of growth or decline entered in Projection Defaults for liabilities. Personal Debt. Enter an approximate amount of the outstanding balance. Same as above. Property Lien. Enter an approximate amount of the lien liability. Same as above. Other Liabilities. Enter an approximate amount of the outstanding balance. Same as above.

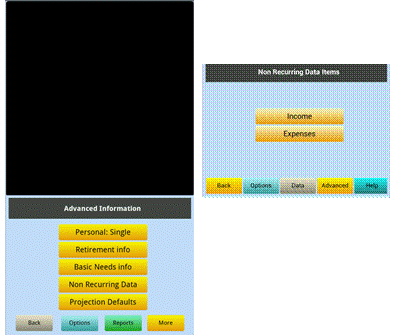

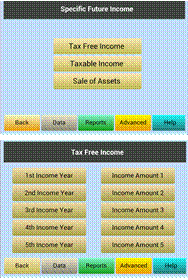

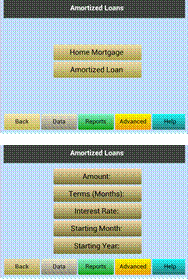

NON-RECURRING DATA ITEMS Non recurring Income  Enter the calendar year in the planning horizon for which the value is being entered in the left column, e.g. 2021. The corresponding tab in the right column should be used to enter the amount of this income. Tax Free Income. This is the amount of cash inflow in the year represented on the left. Taxable Income. This is the amount of cash income in the year represented on the left. Sale of Assets. This type of non-recurring item is available to enter anticipated sales of assets in future. Each sale in turn generates cash inflow in the corresponding year. Nonrecurring Expenses Amortized loans involving projection of liability, cash flow and tax deductibility can be input as follows:  Home Mortgage. This input requires initial terms of the home mortgage for detailed computations. The amortized results are sliced out for the applicable portion to the planning span of current financial profile. Items of information required include- Main input tab: Amortized Loans Amortized Loan. Same as above  Education Expenses. This is the amount of cash expense for education in the year represented on the left. There are two such input menus available enabling specific expense input of up to 10 amounts.  Special Event. This is the amount of cash expense planned for each financially significant event such as a wedding should be entered here. The year of the event should be entered using the left tab and the total amount of expense for this event using the right tab.  Major Purchases. Each major purchase is considered a Cashflow event. Total cost of each purchase should be entered using a tab on the right side. The corresponding tab on the left should be used to indicate the year of this purchase.

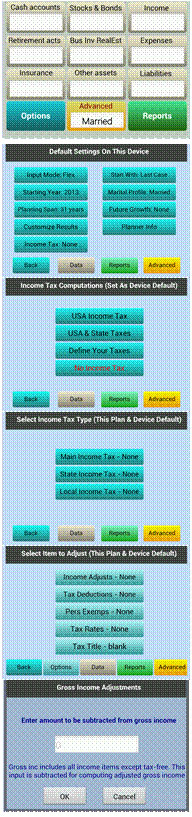

Income tax templates Certain income tax computations such as US Federal Income Tax are built-in as main income tax. Additional main income taxes can be defined using templates that contain your information for deductions and exemptions applied to the calculated income each year and the tax rates to be applied to the resulting taxable income. The tax rates can be defined as graduated tax tables. Similarly the State and City templates can be defined to dynamically approximate the corresponding tax. You can define any one or all of the above as default computations applied to all plans prepared on your device. These computations can be further modified or fine-tuned for each individual case via the Advanced button. The following menu sequence describes a way to reach default main income tax template to initiate or modify (Options, Settings, Income Tax, Define Your Taxes, Main Income Tax)

Your input on items reachable from the above is applied to the current case in each year of the plan to compute this tax. How Does It Work The above process is applied similarly in the computation of State and City Taxes. State and/or City tax amounts computed with these templates are applied as tax deductions in cases where the built-in USA income tax computations are selected. USA Income Tax |

.

.